401Ks, IRAs, and the Miracle of Compound Interest

May 29, 2012

On Tuesday’s “On Point” on NPR, we heard a spirited debate about the right direction for reforming pension plans in the U.S. One guest asserted that the combination currently in place, of 401Ks, IRAs, defined benefit plans, and social Security, just hadn’t done the job and major reform was needed to ensure an acceptable standard of living for tomorrow’s retirees.

David Wray, the other guest and one of the originators of the concept of 401Ks and IRAs back in the ‘70s, disagreed. He observed that people with 401Ks and IRAs are doing pretty well, especially considering that the first wave of Baby Boomers – who are just beginning to retire about now – were 30 years old or older when 401Ks and IRAs came into existence. He has a point, which relates to the mathematical miracle of compound interest.

Consider this scenario: Davy Boomer is born in 1948, and starts contributing $1,000/year to a 401K in 1978, and contributes that amount each year until he retires, at age 65. Let’s further assume that is investment returns 5%/year - that’s about what the U.S. stock market has averaged from 1978 through today, adjusted for inflation and including the bad years.

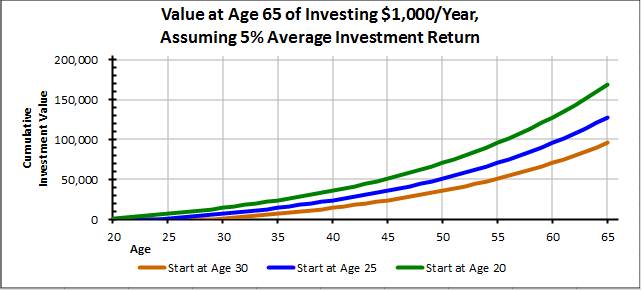

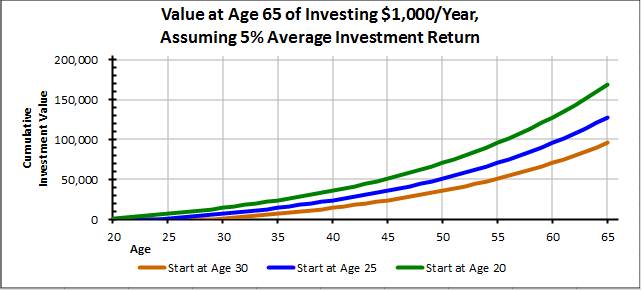

Now let’s add two more scenarios – still Davy Boomer, but instead of beginning to contribute at age 30, he starts at age 25, or at age 20. The following graph shows Davy’s accumulated investment each year until age 65 under all three scenarios:

Under the first scenario – the orange curve, in which Davy Boomer starts contributing $1,000 in 1978, at age 30 – the $36,000 in annual contributions has turned into a nest egg of $96,000 at age 65. Not bad. But the difference between this result and the other two scenarios is stark:

This may seem like magic, but it’s not – it’s just arithmetic. The reason such a small increase in contributions contributes so hugely to the end-result is that money invested in Davy’s 20s stays invested – and growing – much longer than money invested in his 30s or 40s or 50s. When investment counselors tell you it’s never too early to start saving and investing the savings, they’re not kidding.

“Painting with Numbers” is my effort to get people talking about financial statements and other numbers in ways that we can all understand. I welcome your interest and your feedback.

David Wray, the other guest and one of the originators of the concept of 401Ks and IRAs back in the ‘70s, disagreed. He observed that people with 401Ks and IRAs are doing pretty well, especially considering that the first wave of Baby Boomers – who are just beginning to retire about now – were 30 years old or older when 401Ks and IRAs came into existence. He has a point, which relates to the mathematical miracle of compound interest.

Consider this scenario: Davy Boomer is born in 1948, and starts contributing $1,000/year to a 401K in 1978, and contributes that amount each year until he retires, at age 65. Let’s further assume that is investment returns 5%/year - that’s about what the U.S. stock market has averaged from 1978 through today, adjusted for inflation and including the bad years.

Now let’s add two more scenarios – still Davy Boomer, but instead of beginning to contribute at age 30, he starts at age 25, or at age 20. The following graph shows Davy’s accumulated investment each year until age 65 under all three scenarios:

Under the first scenario – the orange curve, in which Davy Boomer starts contributing $1,000 in 1978, at age 30 – the $36,000 in annual contributions has turned into a nest egg of $96,000 at age 65. Not bad. But the difference between this result and the other two scenarios is stark:

- If Davy starts contributing his $1,000/year at age 25 (see the blue curve), his nest egg at age 65 is $128,000. In other words, an additional $5,000 in contributions has led to $32,000 more in investments!

- If Davy starts contributing at age 20 (see the green curve), at age 65 he has $169,000. The additional $10,000 in contributions has led to $72,000 more in investments!

This may seem like magic, but it’s not – it’s just arithmetic. The reason such a small increase in contributions contributes so hugely to the end-result is that money invested in Davy’s 20s stays invested – and growing – much longer than money invested in his 30s or 40s or 50s. When investment counselors tell you it’s never too early to start saving and investing the savings, they’re not kidding.

“Painting with Numbers” is my effort to get people talking about financial statements and other numbers in ways that we can all understand. I welcome your interest and your feedback.

Related Blogs

Other Topics

Other Topics