The Social Security Decision, and the March of Time

Mar 17, 2015

This is the second post in a short series of blogs about the critically important decision American workers face regarding when to start collecting their Social Security. Please share this blog as a public service with anyone you think will benefit from it. If you’re an executive responsible for employee benefits, share it with your coworkers. If you’re a finance professional or sophisticated financially, this discussion may be basic, but even so I encourage you to think of this as an exercise in quantation.

In the last post, we looked at how time affects your decision about when to start collecting Social Security… more specifically how your life expectancy assumptions come into play. But time doesn’t affect just the value of your life, it affects the value of your money as well.

To quantify the impact of time as it affects the value of your Social Security benefits flow, I’ve chosen to use a discount rate of 1.5%, which I arrived at in the following way: (See the Note at the end of this post for a further discussion of “discount rate.”)

- 6% expected return on your investments (or cost of borrowing)

- 25% tax rate, yielding a 4.5% after-tax return (or cost, if deductible interest)

- 3% inflation rate, giving you a real after-tax return (or cost) of 1.5%. (Social Security benefits are adjusted for inflation, but this analysis assumes level annual benefits.)

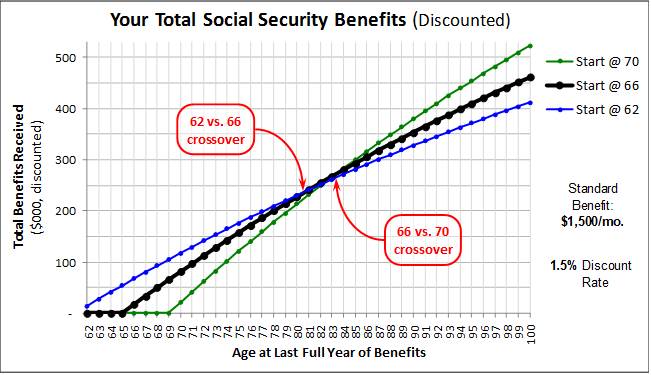

Now let’s look at the same graph we used last time, but this time we discount future cash flows by the 1.5%/year discount rate described above:

A non-zero discount rate causes the “crossover point” – that is, the age at which you start to be better off deferring the beginning of your benefits from age 62 to age 66, and from age 66 to age 70 – to a little later in age. The crossover ages are now about age 81.9 for the 62-vs.-66 decision (it was 79.8 in last week’s undiscounted analysis) and about 84.3 for 66-vs.-70 (it was 82.5). Compared to the life expectancies at ages 62 and 66, you’re still ahead of the game on a pure statistical expectation basis, but it’s a closer decision now.

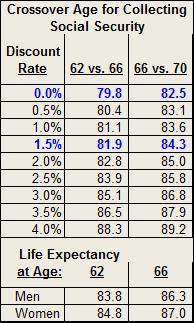

You may want to consider how sensitive your decision is to the discount rate that you choose. Here’s a table that looks at that (with life expectancies at the bottom for comparison):

The analysis only shows discount rates up to 4.0%, because that equates to a pretax return on investments of 10% or more, or an interest rate of 10% on your debt (and less than that if the interest you owe isn’t tax-deductible). So if you fancy yourself a wolf of Wall Street or if you have significant debt issues, you should take the cash as soon as you can.

Folks, we’ve gone as far as we need to go with basic quantation, but there are some “soft” considerations that may also affect this critical decision. Stay tuned – we’ll talk about those in the next post.

The time value of money. We almost always value getting money sooner rather than later. More time adds more risk and uncertainty to your expectations, but more important, having money now means you can invest it and get a return, or you can pay off some debt and thereby avoid interest expense. To quantify the time value of money, we apply a discount rate; the “present value” of money in the future is reduced by that discount rate times the number of years in the future you expect to receive (or pay out) that money.

“Painting with Numbers” is my effort to get people to focus on making numbers understandable. I welcome your feedback and your favorite examples. Follow me on twitter at @RandallBolten.Other Topics